Precious Metals Settle Mixed as a Slump is Stocks and the Dollar Boosts Gold

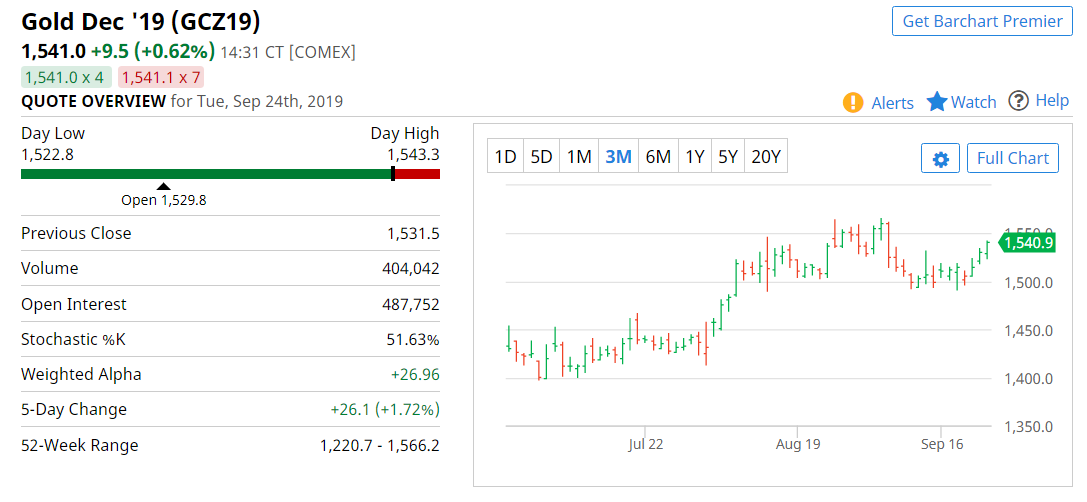

Dec Comex gold GCZ19 on Tuesday closed up +8.7 +0.57 and Dec silver SIZ19 closed down -0.083 -0.44.

Precious metals settled mixed Tuesday with Dec gold at a 2-1/2 week high as a weak dollar and a slump in stocks boosted demand for gold while weak U.S. economic data undercut silver.

A weaker dollar Tuesday was positive for metals and a slide in the S&P 500 to a 2-week low Tuesday boosted the safe-haven demand for gold. Stocks slumped as trade tensions ratcheted higher on President Trump's UN speech in which he accused China of currency manipulation and stealing intellectual property.

Hawkish comments on Tuesday from ECB Governing Council member Villeroy de Gallhau weighed on gold prices when he said that the restart of QE is unwarranted as low interest rates and new guidance are strong enough measures for now.

Tuesday's U.S economic data was negative for economic growth and industrial metals demand after Sep consumer confidence fell sharply by -9.1 points to 125.1, weaker than expectations of -2.1 to 133.0. Also, the Sep Richmond Fed manufacturing index fell by -10 points to -9, weaker than expectations of unchanged at 1. Finally, the U.S. July S&P CoreLogic composite-20 home price index rose by only +2.0% y/y, weaker than expectations of +2.1% y/y and the smallest increase in 7 years.

Precious metals still have strong safe-haven demand from geopolitical risks in the Middle East after Iran's foreign minister last Thursday warned that any U.S. or Saudi strike on his country in response to Saturday's attack on Saudi oil installations would lead to "all-out war." Also, the U.S. Treasury last Friday said it will impose sanctions on the Central Bank of Iran.

Ongoing trade and geopolitical tensions, along with dovish central bank expectations, sparked fund buying of precious metals as long gold positions in ETFs rose to a 6-1/2 year high Monday and long silver positions in ETFs rose to a new record high on Sep 2. More recently, however, fund liquidation reduced long silver positions in ETFs to a 1-month low Thursday.

An offshore commodities and forex trading firm, Red Maple Trading offers a combination of first-class trading advice and an award winning portfolio management team with an exemplary trading record.

Red Maple FX offers both non discretionary trading accounts and fully managed trading accounts. Call Toll Free + 1 888 673 2812